The cost of goods sold is positioned midway in the income statement, immediately after all revenue line items, and prior to general, selling, and administrative expenses.

COGS DEFINITION HOW TO

How to Recognize COGSĬOGS is recognized in the same period as the related revenue, so that revenues and related expenses are always matched against each other (known as the matching principle) the result should be recognition of the proper amount of profit or loss in an accounting period. This approach pushes fixed costs further down in the income statement. There are several variations on these cost flow assumptions, but the point is that the calculation methodology used can alter the cost of goods sold.Ī variation on the COGS concept is to only include variable costs in it, which results in a calculated contribution margin when the variable costs are subtracted from revenues. Conversely, if it uses the last in, first out methodology, it assigns the last cost incurred to the first unit sold from stock. If a company follows the first in, first out methodology, it assigns the earliest cost incurred to the first unit sold from stock.

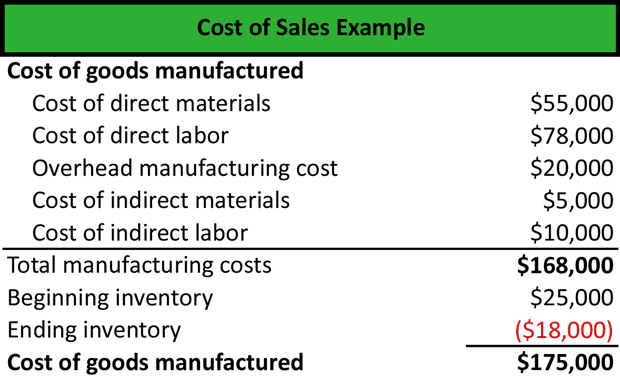

A more accurate method is to track each inventory item as it moves through the warehouse and production areas, and assign costs at a unit level.ĬOGS can also be impacted by the cost flow assumption used by a business. At the least accurate level, it can be a simple calculation of adding purchases to beginning inventory and then subtracting ending inventory, though that approach requires an accurate ending inventory count.

COGS DEFINITION FREE

Get your FREE Freight and Shipping Ebook Guide.There are several ways to calculate COGS. For more information about COGS, you can look online at the IRS Tax Guide for Small Business.Ĭontact bookskeep today for more information on ecommerce bookkeeping and accounting. InventoryLab makes it easy to track COGS and Expenses. Typically there is an expense account in the Cost of Sales section of your Profit and Loss Statement for shipping and it is used in this situation. This expense of shipping to the customer is directly related to the sale of the product, so we include it in the Cost of Sales section and include it in the gross profit calculation. Whenever you pay for shipping out to your customer, this is not included in COGS but is a monthly expense. “Freight in” is defined in the IRS Tax Guide for Small Business as “Freight-in, express-in, and cartage-in on raw materials, supplies you use in production, and merchandise you purchase for sale are all part of the cost of goods sold.” Click HERE to get FREE Freight and Shipping Ebook Guide If you are shipping a product from your manufacturer to yourself, your prep center, or Amazon, this is considered “freight in” and can be included in your calculation for Inventory and COGS. When you are calculating the cost of your products, how do you handle the freight? Is it included in your cost of goods sold calculation? Or do you pay it from an expense account designated for freight or shipping? Luckily, the IRS rules are pretty clear in this area.

0 kommentar(er)

0 kommentar(er)